A closing protection letter is a contract between a title insurance underwriter and a lender. In this agreement, the underwriter agrees to indemnify the lender for actual losses caused by certain kinds of misconduct by the closing agent. Basically, the insurance company is agreeing to hold the ultimate risk and stand behind the policy. If the title company used for the closing is guilty of fraud or dishonestly handles the money or documents, the insurance underwriter will stand by this agreement to reimburse as necessary.

Title underwriters do not work with just any title and closing agent. There is a process of careful vetting and making sure that these agencies have a reputation for meeting their fiduciary duty, thus giving their “stamp of approval”, so to speak, that the lender is safe to do business with them.

The CPL is a filed form which is approved by the Maine Bureau of Insurance and cannot be modified. It is good for 1 year from the date of the letter. However, transaction specific information such as the loan amount, name of parties, etc. can be modified or updated, if needed.

What exactly does a CPL cover? Subject to the specific exceptions and exclusions otherwise noted, the CPL covers loss solely caused by:

(a) any failure of Settlement Agent or Approved Attorney to comply with Your written closing instructions that relate to:

(i) (A) the disbursement of Funds necessary to establish the status of the Title to the Land; or

(B) the validity, enforceability, or priority of the lien of the Insured Mortgage; or

(ii) obtaining any document, specifically required to You, but only to the extent that the failure to obtain the document adversely affects the status of the Title to the Land or the validity, enforceability, or priority of the lien of the Insured Mortgage on the Title to the Land; or

(b) fraud, theft, dishonesty, or misappropriation of the Settlement Agent or Approved Attorney in handling your funds or documents in connection with the closing, but only to the extent that the fraud, theft, dishonesty, or misappropriation adversely affects the status of the Title to the Land or to the validity, enforceability, or priority of the lien of the Insured Mortgage on the Title to the Land.

The cost for a Closing Protection letter is $25 – the entire fee going to the underwriter – and coverage does limit protection to closings which take place in the State of Maine only. It should also be noted that a CPL may only be issued if the underwriter is issuing a title policy in connection with the transaction. In other words, if a title policy is not being issued for a transaction, no CPL can/will be issued for that transaction.

There are some instances where the closing and the title issuance are being handled by different approved agents/attorneys. A CPL may only be issued provided that the closing agent/attorney and the policy issuing agent/attorney both write on the same underwriter.

And of course it probably goes without saying, but only one CPL may be issued per transaction. One CPL benefits the buyer, the borrower, and the lender to the transaction.

* special thanks to Ann and Tiffany at Chicago Title for their input when putting this post together.

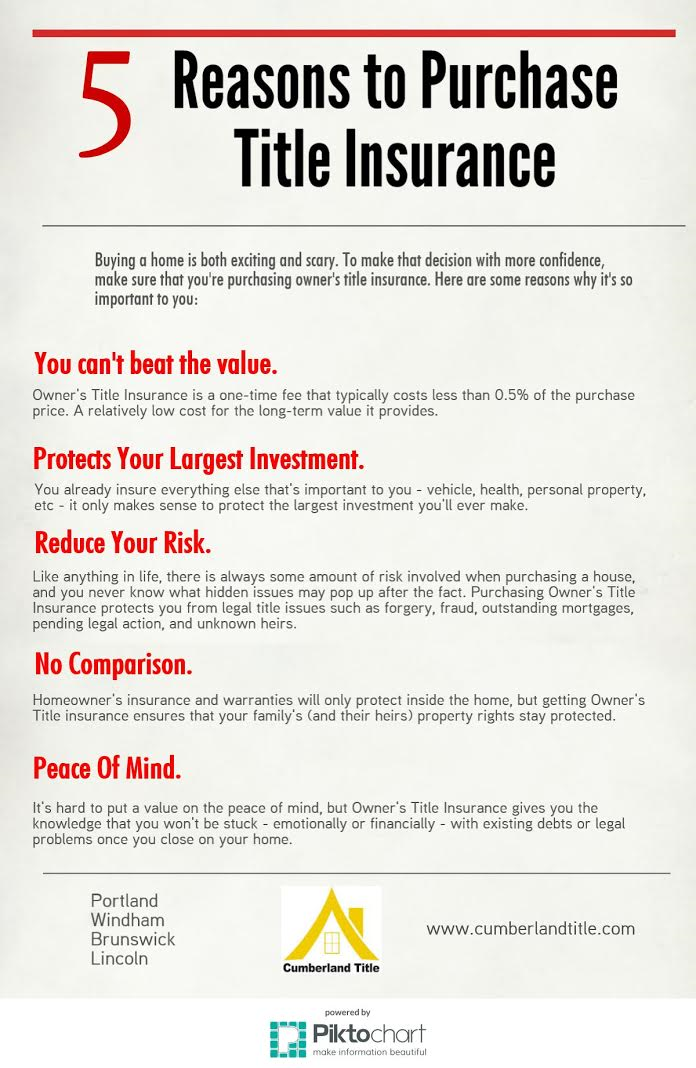

Buying or refinancing a home can mean you’ve got a lot on your plate. I bet title insurance isn’t one of them.

The home buyer – or home re-financer – generally leaves it up to their lender to take care of all the details, and title insurance is actually a pretty big detail. For instance, if the title company finds a title defect or other such issue, it could actually prevent the closing from happening. And that’s a pretty serious complication. In fact, one out of every 3 title searches reveals some kind of title defect that gets fixed before the transaction closes.

The title company hired to handle the closing actually contracts with an underwriting company to issue the insurance policies that will pay to defend you in court if anyone challenges your title, and to compensate you if you lose in court.

Here are 6 questions to ask to make sure you’re making smart choices:

1) Are the prices negotiable? For the most part, prices are basically regulated and you’ll find most of your area title companies charging comparable rates. But call around, ask what they charge. It never hurts to ask. A smart consumer will look for a company that has a history of performing quality title searches, and will also most likely be around for the next 10-20 years if there is a problem.

2) What coverage do I need? The average policy is pretty standard and protects against such things as fraud, undisclosed heirs, forgery, and spousal claims. If you want additional coverage, that will obviously boost the insurance cost. It’s also possible that your lender may require – for example – an endorsement if you have an ARM (adjustable rate mortgage) that guarantees they are first in line to be paid if the home goes into foreclosure.

3) Do I get a choice in title companies? Yes, absolutely. You may find that the seller, your lender, or even your real estate agent may suggest a title company to you – or – they may just pick one for you. But the bottom line here is that you get the final say. Do your homework and call around. Find a company that will answer all of your questions, give you piece of mind that they do quality work and have a stellar reputation, and is charging a rate that you feel comfortable with.

4) Is my money safe? It is pretty mind blowing to think of the amount of money that passes through a title company in a given day, week or month. It’s also pretty astounding how savvy cyber criminals can be these days when it comes to wire fraud and other acts of cybercrime. Ask your title company what precautions and processes they have in place to do their part in preventing this from happening to their customers.

5) In addition to the insurance premium, what other charges might I encounter? Consumers tend to approach a new home with an open wallet if it’s their “dream home” and they really want it. But when it comes to hearing the title insurance quote, they balk at it. What should be considered is that this insurance is actually protecting this large and precious investment that you’re making. Definitely call around to compare rates, but remember to also ask what other fees will apply on top of that. Other fees include those to file the deed with the Registry of Deeds, fees associated with getting payoffs, mail away fees of a party cannot attend the closing in person, Fed Ex costs, just to name a few.

6) Is my title company a neutral third party? Some title companies are owned by real estate firms, lenders, and even builders. Yes, these arrangements are legal when properly structured and disclosed, but some consumers prefer not to tread into waters where a potential conflict of interest may exist. Therefore, ask if the referred company is an affiliated entity. If it is, a good question to ask is if they are providing a level of service that is consistent with industry standards as well as similar to that of competing closing and title companies charging comparable fees.

So be prepared, do your homework, and make some phone calls. And remember, any good title company will be happy to answer each and every question you have in a way that you understand it. Find a company that makes you feel like a welcome part of the process, where you feel comfortable, and most of all where you trust the people handling what is most likely your largest and most expensive transaction in your life.

As always, Cumberland Title encourages you to ask any questions you may have, and to check out our informative YouTube series of short videos aimed at homebuyers.

If you’re buying a house, you’re going to need a title company to do some of the “heavy lifting”, so to speak, to get you through the closing process. Many times the title company isn’t given the attention it deserves as part of the transaction. It should.

You’ve already invested a great deal of time and careful consideration before choosing just the right home, so why wouldn’t you take the same care when looking for a title company? After all, when dealing with a transaction of such high value as well as so many delicate puzzle pieces that all need to be aligned, it’s in your best interest to do your own research and choose a title company that both has a stellar reputation, as well as one that you trust and feel comfortable with.

Not all title companies are alike. Sure, they are required to perform certain tasks and duties, but how they perform those tasks is a big differentiator.

Are all title companies attorney-owned? No, and nor is it a necessity. But is it recommended to do business with one that is? Yes. It is especially important on purchase deals and more involved real estate transactions that stray from the normal closing. This is where a highly experienced title company makes a difference.

Using a title company that is local – versus an out of state entity with only a satellite office near you – is also in your best interest. Think about if any issues arise prior to – or even after the closing – a local company can generally handle any issues rather quickly as they don’t have to check in with the out of state office before making any major decisions. Time can be a valuable commodity in the world of real estate closings.

But not only that, we often hear the mantra, “buy local”. Well this applies to services as well as goods. At its most basic level, buying goods and services locally means the money stays in the community. Added bonuses of supporting local businesses also include promoting entrepreneurship, building strong community ties, and local decision-making with people that know the area and feel the impacts of their decisions.

And speaking of hiring a title company, you have a choice. Your real estate agent or lender may suggest or decide what title company to use, but it’s actually the buyer that has this decision power. Consumers have the legal right to choose their own title company, but rarely exercise that option. So go ahead and call a few places, ask them questions, make sure that you find a title company that you’re comfortable with. Any good title company will be happy to speak with you during your decision-making process, explain the process and fees, and make sure you have all the knowledge you need to understand how everything works. At least do your due diligence and call the one that is recommended to you.

As always, if you have any questions at all about title insurance or even what the title company’s role is in a real estate transaction, Cumberland Title is happy to talk with you, 207-899-4900. And be sure to check out our helpful short video series that helps answer many of the questions homebuyers have about title insurance and the closing process.

Because real estate transactions are considered higher value transactions conducted by either an individual or a business, it’s no surprise that they have become prime targets for hackers.

Typically, a hacker will gain access to the email account of one of the parties involved in the transaction (buyer, seller, lender, real estate agent, title company, or even the attorney), and carefully make note of important information such as closing dates or transactional details such as down payment amounts.

As the closing date approaches, the hacker will actually pose as one of these parties involved in the transaction and send and email with new instructions for wiring funds. Keep in mind that the scammers are very clever and the email address they are sending from will look very similar to one you’re used to getting emails from, but it’s usually altered in a very subtle way to avoid immediate detection.

For example, you may receive emails from the lender at an address of “johndoe@mybank.com”, but the hacker may create an email with a slight and almost unnoticeable twist on this, such as “john.doe@mybank.com”, or “john_doe@mybank.com”, or even “j0hndoe@mybank.com”. (That last one was almost undetectable wasn’t it? If you’ve got an eagle eye, you’ll notice that the “0” in “john” for that last one was replaced with a zero instead.)

At this point the unsuspecting victim mistakenly sends funds to the scammer instead of the intended recipient, and by the time the error is realized, it’s too late and the scammer – and the money – are long gone.

There are ways you can protect yourself. Using secure passwords is an obvious one. Securing your email server and website in general is another important step, and any vendor in the banking industry these days has pretty much made this step the norm in their industry.

Also, never click on links that are inside an email that’s sent to you. These can be very easily spoofed and just end up re-directing you to right to them.

Another highly suggested best practice for any office to put into place would be to follow-up any email with wiring instructions – or more important, changes in wiring instruction – with a phone call to the email sender just to double check. A small “inconvenience” of picking up the phone and re-confirming instructions is definitely worth the “hassle” of making sure hundreds of thousands of dollars doesn’t go to the wrong person, never to be seen again.

When you do business with Cumberland Title you can feel confident that our staff is well-versed in best practices around this topic and have been trained in procedures to do our best to ensure the scenarios described above do not happen on our watch.

Love is fleeting and sometimes ends. But the love of your home goes on and on as long as you have a mortgage. In my short time practicing divorce law there is much to consider, most notably would be the effect on any children from the marriage. And every step should be taken to minimize any effect on them. Other things to consider would be redrawing wills, trusts, and/or any business or partnership agreements. Divorces are complex and emotionally taxing.

But today we are going to focus on the aspects regarding your property. After all, you both signed a mortgage that is going to last longer than your marriage and you are both title holders.

The first thing to note is that once you file for divorce your home will be placed under what’s called a “preliminary injunction.” The soon to be ex-husband and wife will be restricted from, transferring, encumbering, concealing, selling or otherwise disposing of the property of either or both of the parties, except in the usual course of business or for the necessities of life, without the written consent of the parties or the permission of the court. We often get requests to sell property during a divorce proceeding. But in order to do that we would need a letter from each attorney representing the parties and if they can’t agree we would need a court order. Obtaining that order could be a significant delay to any potential sale. And of course it is an added expense.

The next thing to note is that the Judge in the divorce case will be dividing up the property one way or another. Often one spouse will be awarded the property. In that case title can pass to that spouse a couple of different ways. This is where it can get confusing. Sometimes a Judge will state that a deed shall be signed from one spouse to the other. Great. But now the title company is saddled with tracking down the ex-spouse who may not really want to sign. This can be a hassle and a delay, even though it was a court order to sign the deed. We’ve had some spouses give us a really hard time even though they were required to sign it.

A Judge does have another option; he can “award” the property to one spouse or another. In the title company world we like to see a nice clear statement that the property is awarded to one party or the other. Then the party that was awarded the property can ask for an Abstract of Divorce Decree from the clerk of the court. That Abstract will have the party’s names, the date of the judgment, a description of the real estate and it will repeat that same clear statement of the new ownership of the property. That document, that abstract of divorce decree can be recorded in the registry of deeds and functions as a deed! No quitclaim deed from the ex-spouse is needed. This can be especially helpful in contentious divorces or even where one of the spouses simply can’t be found.

Lastly, the court may instruct one party or the other to make a payment of money to the spouse that was not awarded the property. Furthermore, once you remove someone from the title to the property you will have to refinance the property. That will enable you to remove the new non-owner ex-spouse from the mortgage and title. It will also enable you to raise some funds to make any necessary payment.

Please note, if you do make some sort of payment, get some sort of receipt in writing or make a copy of any cashed check. You may need to provide proof of that payment at some later date to make sure you complied with the divorce judgment. Tracking down that kind of proof at some later date can add a costly delay to any transaction you may be trying to accomplish.

You may be breaking up with your spouse and there is a LOT to consider. But keeping an eye on a few simple things when it comes to your property can save a lot of headache later on.

As always if you have questions or would like to pick my brain on this or any other real estate issue please feel free to call me. My office number is 207-899-4900. We are based in Maine with four offices around the state and are here to help.

Matthew J. McDonald, Esq.

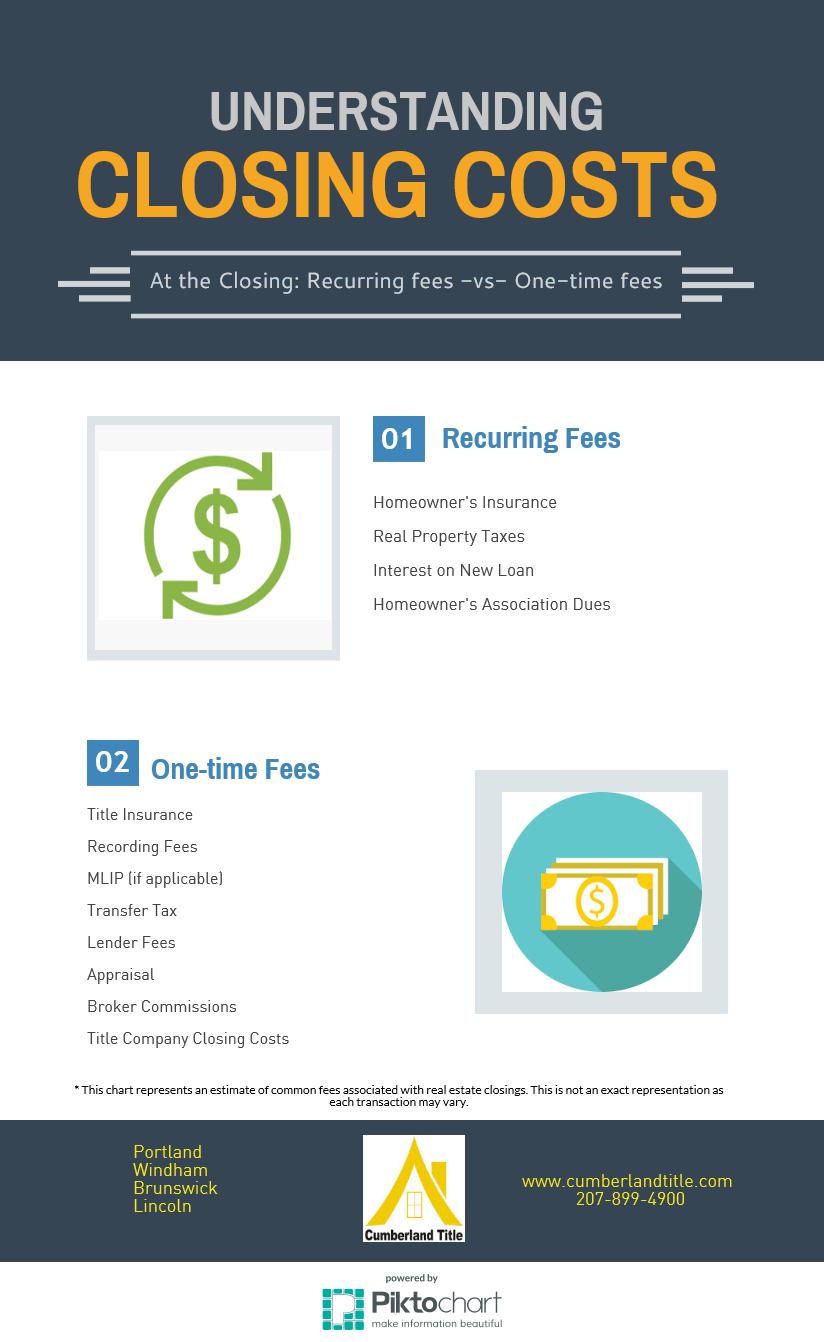

By now if you’ve been reading our blog posts, you know that there are fees in a real estate transaction that apply to both the buyer and the seller. Some people are confused by what costs the seller is responsible for, and what exactly they’re getting for services to justify that fee.

Cumberland Title charges $125 to the seller when we are closing a real estate transaction. Some of the things that the title company has to do in relation to the seller is contact the creditors that the seller wishes to pay off with the proceeds of the sale to get final payoff figures for the outstanding balances, this includes the current mortgage on the house. (And some of these creditors even charge a fee just to get this information!)

In a nutshell, these fees cover costs/manpower associated with:

- Ordering, obtaining and reviewing the title (so that there are no “surprises” that could potentially prevent the real estate transaction)

- Obtaining tax information from the municipality

- Payoff of liens, previous mortgages, etc.

- Closing document preparation

- Communication with borrowers, sellers, brokers, etc.

- Conducting the closing

- Final recording of documents and any other matters relating to the loan closing.

Sure, you can go your own route and choose to hire a real estate attorney to do these things for you, but it’s most likely their hourly fee will be much higher than our “one time” fee. And then there’s also the convenience and logistics of having one title company handle the entire transaction from start to finish, with fewer risks of communication issues.

If you have more detailed questions about this or any aspect of the title company’s role in the real estate transaction, please feel free to reach out to us at matthew@cumberlandtitle.com

The Ins & Outs of Wiring Money

Funding – aka “the money” – is a very important part of the closing process when it comes to buying/selling a house. The buyer needs to have it, and the seller wants it. There are a couple of different ways that this can happen, either by check or by a bank wire.

Now a check is pretty self-explanatory, but let’s hit on a few important and key points of this type of transaction. The buyer check should not be a personal check made out to the seller. It should also not be a check made out to the buyer and then signed over to the title company (making it a third party check). It should be a bank check, or even more ideal – and to be as safe as possible – the funds should be given to the title company (if applicable) and they will present their check to the seller. This creates a nice paper trail that any auditor will tell you is good practice.

A wire is a little trickier. In simplest terms, a wire is when money is transferred electronically from one account to another, whether the same banking institution or not. I’m sure you’re thinking, “What’s so hard about that? Just type in a few account numbers and hit ‘send’.” Well, it’s not quite that easy.

Keep in mind that every banking institution has different rules and regulations in which they follow that meet their own internal best practices. And it’s also reasonable to believe a large global bank may have different policies than, say, a small credit union might.

Title companies also see their share of “back to back” closings where a seller closes on the sale of their house and then turns around an hour later and becomes the buyer in another transaction. As exciting as this can be for the seller/buyer in this scenario, they could just be setting themselves up for a headache by scheduling things so tightly.

Here’s some facts about wires that all title companies wish more people were aware of:

- Some banking institutions only process wires at scheduled times of the day, and sometimes only 1-2 times at that!

- Wires don’t necessarily happen instantaneously once they are processed, there can be a “lag time” of an hour or more in some cases.

Both of these facts can be real game changers when it comes to the closing transaction.

Let’s say a seller just left the closing on the sale of their house and are heading right away to the closing on a home they are purchasing. If they deposit a check for proceeds to the house they just sold and try to write another check using those funds to purchase the new house, those funds may not all be available right away, as many banks need time for the check to “clear”, and only release a portion of a large sum immediately (please note, banks have differing policies on this).

Or, if the seller has funds wired into their account and then an hour or less later tries to wire funds to the new seller of the house they are buying, it can take hours for those funds to show up. And guess what happens at the closing when there is no funding? Well, in a nutshell, there is no closing. The seller doesn’t get paid, nor do the realtors, as the title company/attorney is not permitted to hand out any checks until the funding is in place and the transaction is completed.

Your takeaway today should be threefold. First, try to avoid back to back closings at all costs if you can. At least try and spread them out by a few hours to give some time for the dust to settle from the first one.

Secondly, if you can’t avoid back to back closings, at least try to have them both at Cumberland Title so that we can make sure the funds from the first closing are then used right away at the second closing.

And lastly, if you are going to do back to back closings at 2 different title companies, make sure you check with the both of them on what is the best way to accomplish this to avoid any issues. Generally speaking, we will accept a trust account check from another MAINE BASED title company if it can be made out directly to us.

There’s nothing worse than tears or frustration on what should be a happy occasion, so make smart choices and be prepared. Happy house hunting (or selling)!

Breaking Up With your Home: Handling Homeownership During A Divorce

Sometimes love is fleeting and marriages end, but that mortgage you agreed to pay together back when you were still in love is still your responsibility…until you find a way to divorce that, too.

Usually, the mortgage is the biggest liability a divorcing couple has to split, but divorcing your mortgage isn’t always easy.

As far as your mortgage lender is concerned, if the mortgage was taken out in both of your names, then you are still required – and expected – to pay that every month.

Here are a few options that you should consider when deciding how to handle the house & mortgage if you find yourself going through a divorce:

Selling the House

If neither party is interested in keeping the house, then selling it and splitting any profit after the mortgage is paid off from the proceeds is a decent and fairly straight forward option. Keep in mind other factors like the current housing market and how much is still owed on the mortgage versus what you are able to sell the home for. It needs to make sense to be able to sell the home for at least what is owed on it.

Keeping the House and Refinancing

Maybe one of the spouses has a strong preference to stay in the house versus selling it. In this case, they will need to make sure that the other spouse is off the hook from any financial responsibility to the house free and clear. The way to do this is for the spouse wishing to keep the house to refinance the current loan themselves.

In order for this to work, the mortgage should not be “under water”, the other spouse is not contesting that they agree to let the house go, and the spouse wishing to keep the house has sufficient credit and income to qualify for a loan and subsequently continue to make mortgage payments alone every month.

Keeping the Mortgage As Is

This is obviously a risky option, especially depending on how amicable the divorce actually is. But if neither spouse is able to refinance the loan on their own, they’re unable to sell the home, or to pay off the existing mortgage, you could leave the mortgage as is.

In this risky scenario, the spouse not living there would basically be “hoping” that their ex is making the payments each month. If not, both of their credit will get tainted as a result.

And here’s a pro tip: just getting yourself off of the Deed does not mean that you’re off the mortgage as well. This is a very important distinction that you should be aware of and understand up front.

And make sure also that the divorce decree specifically spells out who will be responsible for the mortgage and what happens if the spouse in the house misses a mortgage payment. Suggestions include that the divorce decree specifically state that the house must be sold or refinanced within a specific time period.