When a title company is contacted to facilitate the closing for a property transaction, there is a great deal of information that they must gather in order to accurately allocate all monies and ensure that the documents reflect the most current, up to date and accurate information.

One of the first things we do here at Cumberland Title is send out a questionnaire to both the buyer and seller, as well as to each realtor. The information on each document asks for vital information that is required by the title company in order for them to accurately and expeditiously prepare the lengthy package of closing documents.

For example, some of the information asked on the seller’s questionnaire is whether they have any mortgages, loans, etc. that they are looking to pay off with the sale of the property. For obvious reasons, the title company needs to know this information. In the event that an existing mortgage is going to be paid off with part of the proceeds, the title company needs to know who holds the mortgage and the account number associated with this, as well as the seller’s signatures and social security numbers. Without this information, the title company is unable to order a “payoff” for the existing loan. Also worth mentioning, when a payoff is ordered, it can sometimes take up to a week to receive the requested information back, so having this information from the seller as far in advance as possible helps to prevent things like a closing being held up or pushed back simply because we didn’t receive the payoff figures in time, or the sellers had another loan to payoff that they never disclosed because they didn’t return the questionnaire. Even if there are no outstanding loans associated with the property, it is still vital to have that questionnaire returned stating exactly that, so there are no questions and time isn’t spent trying to follow up with the seller or their real estate agent trying to get this information.

For buyers, again, every question asked on the form is information that is required by the title company before the final closing can happen. That includes knowing who has been chosen as the home owner’s insurance company. If you are having difficulty choosing one, perhaps your real estate agent can refer a few for you to call and check rates before you decide. Nonetheless, you will need to have this established before the closing so that your binder can be included in with the closing package.

As for the real estate agents, it is vital that we receive those questionnaires back also, as this ensures we have not only their most updated contact information so that we can keep them in the loop throughout the process, but it also ensures that the correct commission amounts get applied to the transaction so there are no unhappy people on closing day when the commission checks are handed out.

In a nutshell, the recurring theme here is “communication”. In order to ensure that the required information is transferred between parties for a smooth transaction and closing, it is vital that all of the information asked of you by the title company is given to them in a timely manner. And when in doubt, call them before just deciding not to return the form.

As always, Cumberland Title aims to make this as smooth and hassle free of a transaction as possible for all parties involved. If ever you have questions about the process itself, or anything specifically on the questionnaire, please do not hesitate to reach out to us, matthew@cumberlandtitle.com or 207-899-4900.

Elder abuse cases often highlight the reality that the same frailties and vulnerabilities that make older clients easy victims, also make them imperfect witnesses and poor advocates for themselves. The state of Maine, however, has taken a unique approach in protecting its elderly from financial exploitation.

In 1987 a group of lawyers advocating for financially exploited elders undertook a legislative initiative, at a time where there was very little awareness of the problem. The result was The Improvident Transfer Act (33 M.R.S.A. 1021 et seq.).

At this time, Maine’s Legal Services for the Elderly (LSE) was seeing a sharp increase in the number of older people who had divested themselves from their assets, where most often the recipients of these assets were family members or others that the elderly person had a close and trusting relationship with.

In many cases, older people are generous with their family and make financial gifts willingly – free from inappropriate influence – for such things as assisting with college tuition, a down payment on a house, transferring real estate, and compensation for caregiving expenses.

However, the LSE was seeing – and still continues to see – clients in distress after giving up assets before they were ready, which left them in a precarious financial circumstance including being left destitute or even evicted.

The idea behind the proposed legislation was to shift the burden of proof from the transferor to the transferee by creating a presumption of undue influence under a limited set of circumstances:

- Transferor was “elderly” (age 60 or older);

2. Transferor was “dependent” on others;

3. Transferor was in a “confidential or fiduciary relationship” with the transferee;

4. Transferor did not have “independent counsel”:

5. Transfer was made for less than full consideration; and

6. Transfer of assets was “major” (19% or more of the elder’s estate)

After some initial opposition and amendments, most elder advocates have become strong supporters. In fact, attorneys appreciate that from a client-relationship standpoint, this legislation has allowed them to avoid the awkward position of being asked to represent both parties in these transactions.

If you have questions about this or any other aspect of real estate transactions, we are here to help! Send your questions to matthew@cumberlandtitle.com and we are happy to answer them and guide you in the right direction. Understanding the process is important and we strive to educate and simplify the process regardless of what side of the transaction you’re on.

Unless you paid cash for your home, then you most certainly were required by your lender to purchase a lender’s title insurance policy when you bought your home. If you refinance that home, your lender will again require you to buy a new lender’s title policy.

There are a few reasons for this. Each time you re-finance, the lender needs to know that they will be in first place lien position in the event the mortgage payments stop getting paid and there is a foreclosure. Also, once you refinance your home the old loan is paid off and therefore the title policy expires. So when you refinance (ie: take out a new loan), your lender will most certainly require a new loan policy on your new mortgage to protect their investment in the property.

Your original policy is valid for as long as you own the property, but does not insure the new mortgage created for you when you refinance, and it also doesn’t provide protection against events that may have transpired between the original purchase and this refinance (ie: liens that may have been placed against the property).

Just as we as consumers are always looking for ways to protect our interests, understandably so is your lender.

If you or your clients have any questions about title insurance – whether it’s in regards to a refi or not – Cumberland Title is always happy to help you understand the process better by answering any questions you have.

We’ve explained in the past how wire fraud – and other types of banking related fraud – are becoming widespread these days. Well one of the ways criminals are achieving this is through “phishing” scams.

The term “phishing” is fairly broad. Some are somewhat harmless internet rollers, while others are professionals that have become more than savvy at snatching up and selling your personal information. In either scenario, phishers are never trying to help you.

Remember the trend a decade or so ago of emails sent to us from supposed rich princes or diplomats that just needed a few thousand dollars until they could access their inheritances, and their promise to repay you 10 times over once they had access to it? Well today many of the scams can be a straightforward as that. They will try to scare you with a ruse such as telling you there is an issue with your email web service and ask you for information such as your full name, email address, password, and date of birth. Other phishing attempts may ask alert you to supposed “suspicious activity” to your account and request that you fill out an info form or click a link that they’ve provided.

It’s important to note that these emails will look and sound real and important, and may even use familiar logos. But once you log into their link or reply back with the requested information, you have now fallen right into their trap and they have exactly what they need from you.

In some cases they may send malicious downloads and viruses to your computer tat could literally track every keystroke that you make on that computer. This means they will now have access to your shopping history, login credentials, passwords, credit card info, home address, and so much more. The repercussions are far-reaching, and a lengthy and frustrating process awaits you to try to reverse the effects.

But the good news is you can protect yourself if you follow a few simply rules to stay safe:

1) Beware of Urgency: Phishers use fear to get you to take action. If you receive an unusual & unexpected email urging you to take immediate action, think and investigate before you react.

2) Delete it: Don’t be afraid to delete any message (email, voicemail) if you don’t know the source.

3) Don’t Believe Everything: If you receive unexpected correspondence, try contacting them by a different means. In other words, don’t click on their links, try going to their office or call a local branch (if it’s a bank, store, or utility, for example)

Phishing scams can only exist as long as there are enough people falling for these tricks. Your best defense will always be to use caution, be defensive, and delete anything that looks suspicious. And never try to confront a phisher directly – even over the phone or via email!

A title underwriter is an entity that authorizes and issues authority for its agents (title agencies, like Cumberland Title), to write title insurance policies. The underwriter assumes the ultimate financial risk as they stand behind the policy and actually insures the property against insurance defects. They also agree to defend the owner of the title policy in court should ever the need arise surrounding legal issues with the title.

A title underwriter possesses a certain set of skills to do their job effectively. They bear a knowledge and expertise about the law and how it applies to specific situations, the ability to analyze and understand the associated risks involved in a transaction, experience and judgment to perceive the magnitude and probability of the risks, as well as a keen awareness of the many intricacies of a title insurance policy.

A title agency – such as Cumberland Title – is an agent for the underwriter, which has been carefully vetted to meet strict standards of the underwriter. We are authorized to issue title commitments and title policies on behalf of the underwriter, and prepare documents for those transactions. The title underwriter trusts that we will properly and thoroughly examine property records so as to determine rightful ownership, as well as make investigate for any possible liens, encroachments, or easements associated We would not represent the title holder in court, nor give legal advice pertaining to that if such a situation arose.

Both entities are regulated by the Bureau of Insurance, which regulates the insurance industry through examining and licensing procedures of insurance companies, reviewing rates and coverage forms, and conducting audits.

As always, if you have any questions about this topic, please feel free to reach out to Cumberland Title at matthew@cumberlandtitle.com.

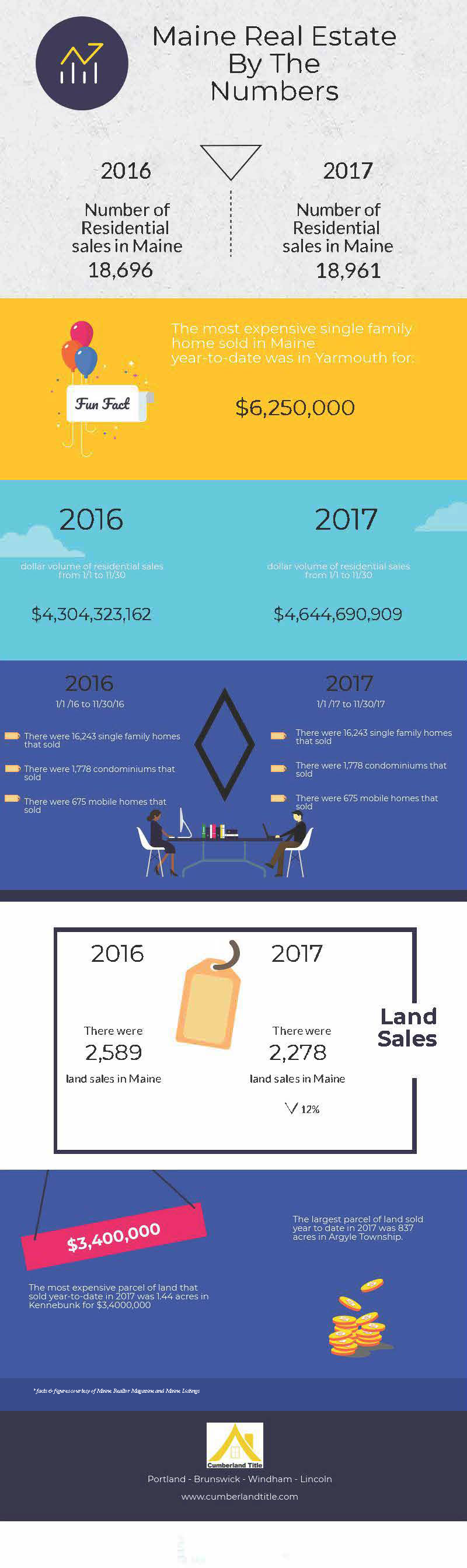

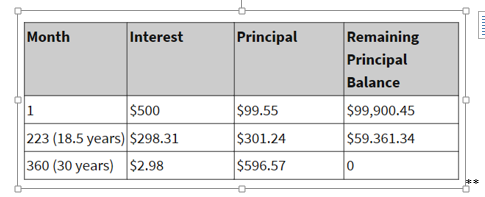

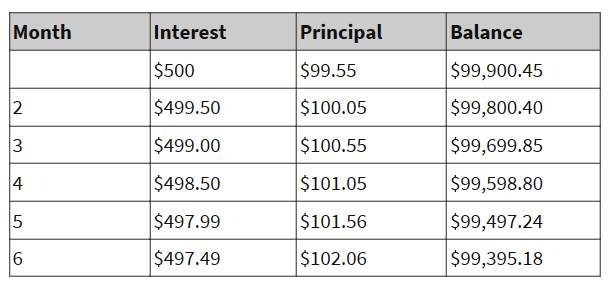

You may have noticed the Amortization Schedule when signing mortgage documents, which is basically a really long calculation of all the mortgage payments the borrower will be making for as long as the mortgage was taken out for. Simply put, “amortization” is the difference between the monthly mortgage payment and the interest portion it contains. It is actually one of the most important – yet overlooked – documents at the signing, as it contains the actual, true cost of the real estate purchase.

For example, if a loan amount was $100,000, at an interest rate of 6%, over the term of a 30-year mortgage. There are 360 payments in that 30-year time period, with a monthly payment of $599.55. The total interest paid is actually $115,838.19.**

As you can see in that example, the interest alone is actually more than the original loan amount, bringing the total cost of the loan to when all is said and done to $215,838.19.

Although the monthly payment stays the same for the 360 payments, the way it is allocated between interest and principal shifts over time. See the above breakdown for payments 1, 223, and 360 in the example we just spoke of. The payments shift from the majority going towards interest, to the majority going towards the principal.

All payments are due on the 1st of the month, however, lenders generally afford borrowers a “grace period” of usually 15 days. This means a payment made between the 1st and the 15th of the month is the same, but anything received after the 15th is assessed a late fee (in many cases equal to 4-5% of the normal monthly payment amount).

Making Extra Payments

When a borrower decides to increase the amount of their payment, the principal payment increases by the same amount, therefore the balance is reduced by that amount.

Extra payments that are made later in the month may have the same effect, or they might not be credited until the following month, dependent upon the lender. In order to be credited in the same month, extra payments must be received by a certain day of the month (which is dependent on the individual lender’s policy).

If we again used our previous example, and were to consider what would happen if the borrower made just one extra payment a year in the amount of $600. The schedule below shows that by doing this during the first year of the mortgage, it will give the borrower nearly as much equity as they would have earned in half a year of making jus the standard payments. By continuing to make just one extra payment a year, it will allow you to cut years off your mortgage, thus saving thousands of dollars in interest.

So make sure that you don’t just quickly pass by this important multipage document at the closing. Look it over, make sure you understand it, and ask questions. The lender considers this one of the most important documents at the closing, so you should, too.

** example used courtesy of Investopedia

When a title company is contacted to facilitate the closing for a property transaction, there is a great deal of information that they must gather in order to accurately allocate all monies and ensure that the documents reflect the most current, up to date and accurate information.

One of the first things we do here at Cumberland Title is send out a questionnaire to both the buyer and seller, as well as to each realtor. The information on each document asks for vital information that is required by the title company in order for them to accurately and expeditiously prepare the lengthy package of closing documents.

For example, some of the information asked on the seller’s questionnaire is whether they have any mortgages, loans, etc. that they are looking to pay off with the sale of the property. For obvious reasons, the title company needs to know this information. In the event that an existing mortgage is going to be paid off with part of the proceeds, the title company needs to know who holds the mortgage and the account number associated with this, as well as the seller’s signatures and social security numbers. Without this information, the title company is unable to order a “payoff” for the existing loan. Also worth mentioning, when a payoff is ordered, it can sometimes take up to a week to receive the requested information back, so having this information from the seller as far in advance as possible helps to prevent things like a closing being held up or pushed back simply because we didn’t receive the payoff figures in time, or the sellers had another loan to payoff that they never disclosed because they didn’t return the questionnaire. Even if there are no outstanding loans associated with the property, it is still vital to have that questionnaire returned stating exactly that, so there are no questions and time isn’t spent trying to follow up with the seller or their real estate agent trying to get this information.

For buyers, again, every question asked on the form is information that is required by the title company before the final closing can happen. That includes knowing who has been chosen as the home owner’s insurance company. If you are having difficulty choosing one, perhaps your real estate agent can refer a few for you to call and check rates before you decide. Nonetheless, you will need to have this established before the closing so that your binder can be included in with the closing package.

Buyers will also be asked if they wish the Deed to be held as “joint tenants” or “tenants in common”. A quick way to differentiate between the two: if the buyers are spouses – for example – it is customary to choose “joint tenants”, that way if one of them passes away, the ownership transfers to the other surviving spouse. “Tenants in common” would be used if the buyers were business partners – for example – and if one passes, that person’s heirs/family could take over their share, versus all of it passing over to the other remaining names on the Deed.

As for the real estate agents, it is vital that we receive those questionnaires back also, as this ensures we have not only your most updated contact information so that we can keep them in the loop throughout the process, but it also ensures that the correct commission amounts get applied to the transaction so there are no unhappy people on closing day when the commission checks are handed out.

In a nutshell, the recurring theme here is “communication”. In order to ensure that the required information is transferred between parties for a smooth transaction and closing, it is vital that all of the information asked of you by the title company is given to them in a timely and accurate manner. And when in doubt, call them before just deciding not to return the form.

As always, Cumberland Title aims to make this as smooth and hassle free of a transaction as possible for all parties involved. If ever you have questions about the process itself or anything specifically on the questionnaire, please do not hesitate to reach out to us, matthew@cumberlandtitle.com or 207-899-4900.

How it affects you

House Republicans recently unveiled a pretty massive tax bill that includes a limit on how much mortgage interest homeowners can deduct – capping it on mortgage debt up to $500,000 – which is down from the $1,000,000 we’re used to today.

This lower limit – if the bill passes – would not impact existing homeowners, but it would apply to all new mortgages.

This year so far, 5.4%* of all loans originated (or roughly about 325,000 loans) were for more than $500,000. While the medium home price across the US is currently at around $254,000**, the current deduction helps to make home buying more affordable, as buyers across the nation are facing higher prices as low home inventory is pushing prices up. Competition currently is causing bidding wars and a lack of affordable homes in many areas. As this trend continues, it would naturally increase the average home price to what we’re seeing currently.

Also under this proposed plan, you may want to think twice before taking out a home equity loan or line of credit, as this bill will not allow you to deduct the interest.

What’s in it for them

In order to claim the mortgage interest rate deduction, homeowners need to itemize on their taxes. But this tax overhaul would also nearly double the standard deduction, which could mean that fewer people utilize itemized deductions and move over to the standard deduction, thus elimination the ability to deduct their mortgage interest payments. Estimates are showing that the percent of filers who claim the deduction would fall from 4% to 21%***

Proponents for the bill have argued that implementing this cap would raise nearly $319 billion in tax revenues over 10 years, which could then potentially be used to lower everyone’s rates.

Possible repercussions

This mortgage interest deduction cap will more than likely become a point of dispute as the bill moves forward, with the home building industry already strongly voicing their opinion against the plan. The National Association of Home Builders has stated that there are 7 million homes on the market right now that are over $500,000, and the proposed cap would devalue the homes. The Association further states that once house values start to decrease in one market, it spreads to the next – and so on – and they fear a housing recession would closely follow.

Here are a couple more articles on the topic:

*Data collected from ATTOM Data Solutions

**Data collected from National Association of Realtors

***Data collected from The Tax Policy Center

(Cumberland Title strives to inform and educate about issues and topics affecting our industry, and will always do so in an un-biased manner. Our goal is to simply report facts, and thus we encourage you to seek out your preferred sources when it comes to news items to get a full range of views for the topic.)