You may have noticed the Amortization Schedule when signing mortgage documents, which is basically a really long calculation of all the mortgage payments the borrower will be making for as long as the mortgage was taken out for. Simply put, “amortization” is the difference between the monthly mortgage payment and the interest portion it contains. It is actually one of the most important – yet overlooked – documents at the signing, as it contains the actual, true cost of the real estate purchase.

For example, if a loan amount was $100,000, at an interest rate of 6%, over the term of a 30-year mortgage. There are 360 payments in that 30-year time period, with a monthly payment of $599.55. The total interest paid is actually $115,838.19.**

As you can see in that example, the interest alone is actually more than the original loan amount, bringing the total cost of the loan to when all is said and done to $215,838.19.

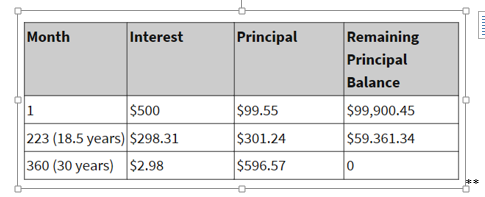

Although the monthly payment stays the same for the 360 payments, the way it is allocated between interest and principal shifts over time. See the above breakdown for payments 1, 223, and 360 in the example we just spoke of. The payments shift from the majority going towards interest, to the majority going towards the principal.

All payments are due on the 1st of the month, however, lenders generally afford borrowers a “grace period” of usually 15 days. This means a payment made between the 1st and the 15th of the month is the same, but anything received after the 15th is assessed a late fee (in many cases equal to 4-5% of the normal monthly payment amount).

Making Extra Payments

When a borrower decides to increase the amount of their payment, the principal payment increases by the same amount, therefore the balance is reduced by that amount.

Extra payments that are made later in the month may have the same effect, or they might not be credited until the following month, dependent upon the lender. In order to be credited in the same month, extra payments must be received by a certain day of the month (which is dependent on the individual lender’s policy).

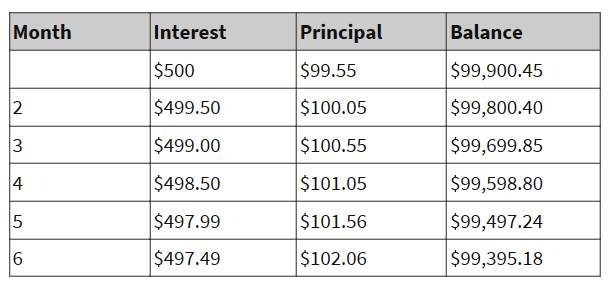

If we again used our previous example, and were to consider what would happen if the borrower made just one extra payment a year in the amount of $600. The schedule below shows that by doing this during the first year of the mortgage, it will give the borrower nearly as much equity as they would have earned in half a year of making jus the standard payments. By continuing to make just one extra payment a year, it will allow you to cut years off your mortgage, thus saving thousands of dollars in interest.

So make sure that you don’t just quickly pass by this important multipage document at the closing. Look it over, make sure you understand it, and ask questions. The lender considers this one of the most important documents at the closing, so you should, too.

** example used courtesy of Investopedia